It is the annual fisheries trade show in Brussels this week. Taxi drivers are trebling their prices, and hotels only doubling their rates. Autumn weather has returned for a visit at the end of April. Is the economic outlook for fishermen so uncertain?

There is an easy way to find out how the catching sector is doing and that is read the annual “The 2015 Annual Economic Report on the EU Fishing Fleet” (STECF) available here. If you don’t want to read the 434 page report, here are some highlights.

2013 and 2014 were good years for most, and spectacular for some

If you listened to the ongoing debate about the UK membership of the EU, you would think that fisheries in the EU and the UK in particular was a disaster. The economic data is less exciting.

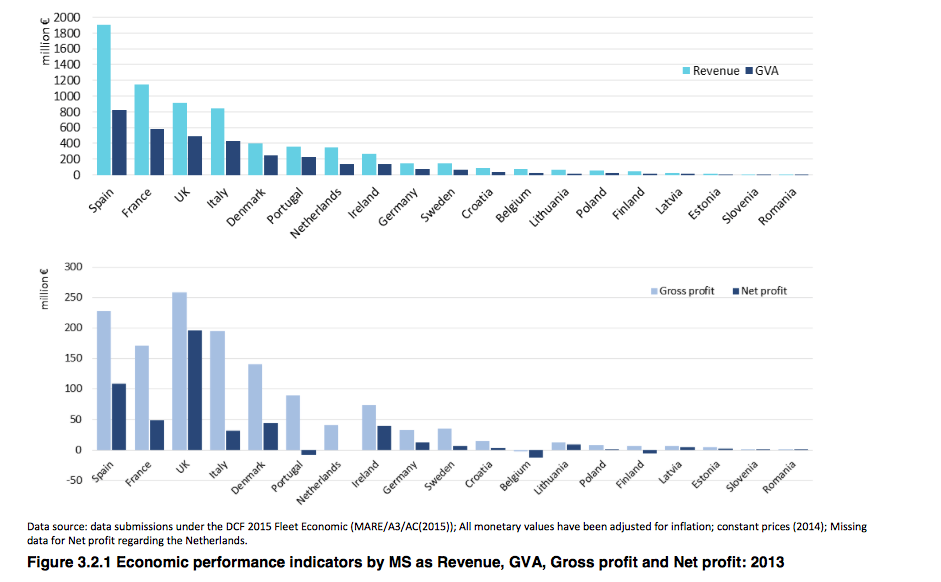

STECF state” The amount of Gross Value Added (GVA) and gross profit (all excl. subsidies) generated by the EU fishing fleet (excl. Bulgaria, Cyprus, Greece and Malta) in 2013 was €3.4 billion and €1.3 billion, respectively. GVA as a proportion of revenue was estimated at 49% and gross profit margin at 20%. With a total net profit of €506 million for the EU fleet in 2013, 7.8% of the revenue was retained as net profit. Sixteen out of nineteen member states (excludes Bulgaria, Cyprus, Greece and Malta) generated net profits in 2013; the remaining three MS (Belgium, Finland and Portugal) generated net losses” (page 24). 2014 projections are positive with ” all Member States analysed generated net profits in 2014, with the exclusion of the Netherlands, Belgium and Poland” (page 24).

This said, as someone mentioned to me this week, fishermen and farmers are the same, how ever good it is, they will always say it is bad. There is an objective way to see how an industry is performing. It is to look at the RoI – the Return on Investment. In this low interest rate environment, some of the returns from some countries are enticing.

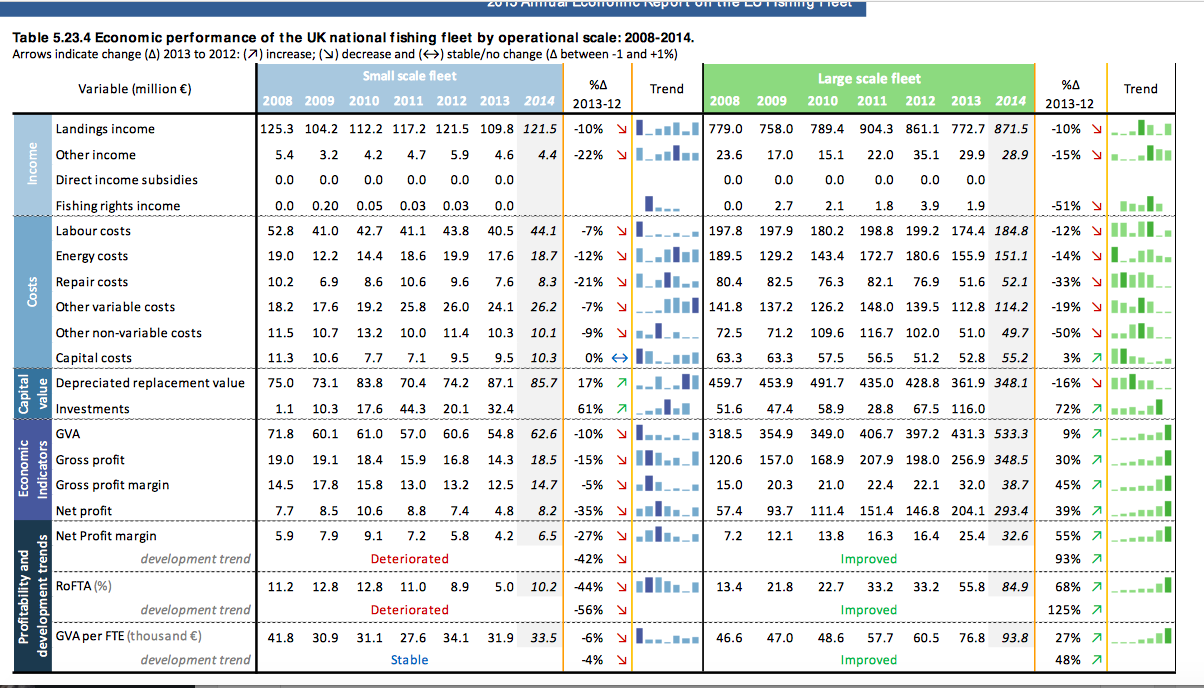

You’ll see from the chart below, that some countries are doing very well. The British fleet in 2013 was making 23% net profits!

Indeed, the large-scale fleet was making in 2014 a projected net profit margin of 32.6% and a RoFTA of 84.9%. These numbers would have put the best hedge fund manager to shame in the hey day. The small-scale fleet was not doing so well, but not too badly, making 6.5% net profits or 10.2 % RoFTA. These are levels many firms would be very happy with, especially in the hight of a grim recession.

See Report, page 55.

The report provides clear summaries of the economic performance of each country’s fisheries. I have listed them below. The report uses RoFTA (Return on Fixed Tangible Assets) is used as an approximation of ROI

You’ll see that economic performance between large and small-scale fisheries can often vary a lot within a country and between countries. Some fisheries are clearing excellent net profits – some in excess of 30% – and others making continual losses.

UK

See Report, p.385.

RoFTA large-scale fleet 84.9%, small-scale fleet 10.2%

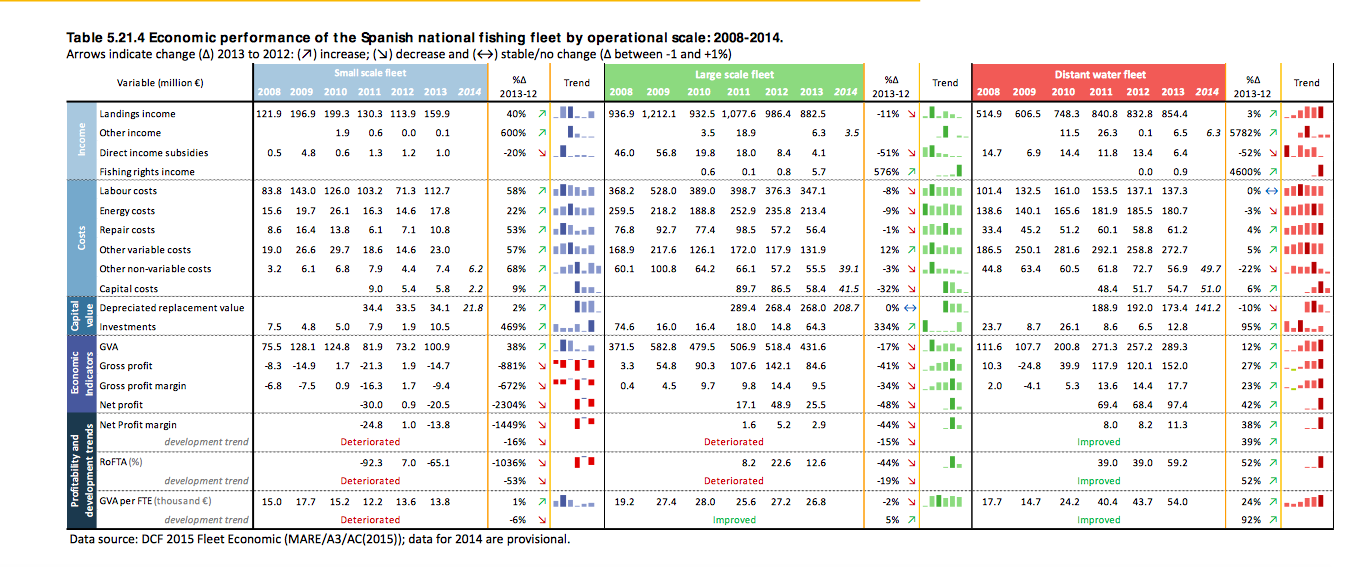

Spain

See Report, p. 367.

RoFTA large-scale fleet 12.6%, small-scale fleet – 65.1%, distant water fleet 59.2%.

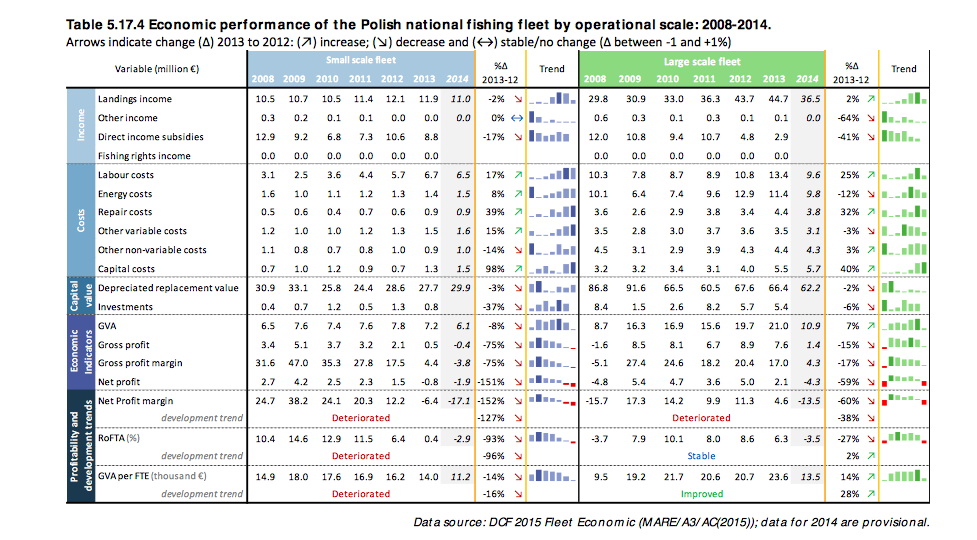

Poland

See Report, p.322.

RoFTA large-scale fleet – 3.5%, small-scale fleet -2.9%

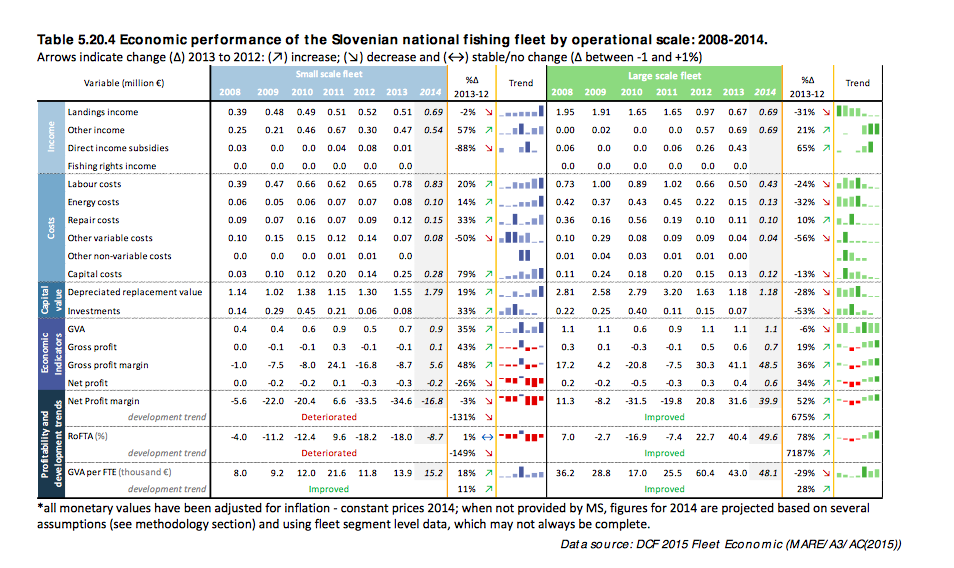

Slovenia

Report, p.356.

RoFTA large-scale fleet 49.6%, small-scale fleet -8.7%

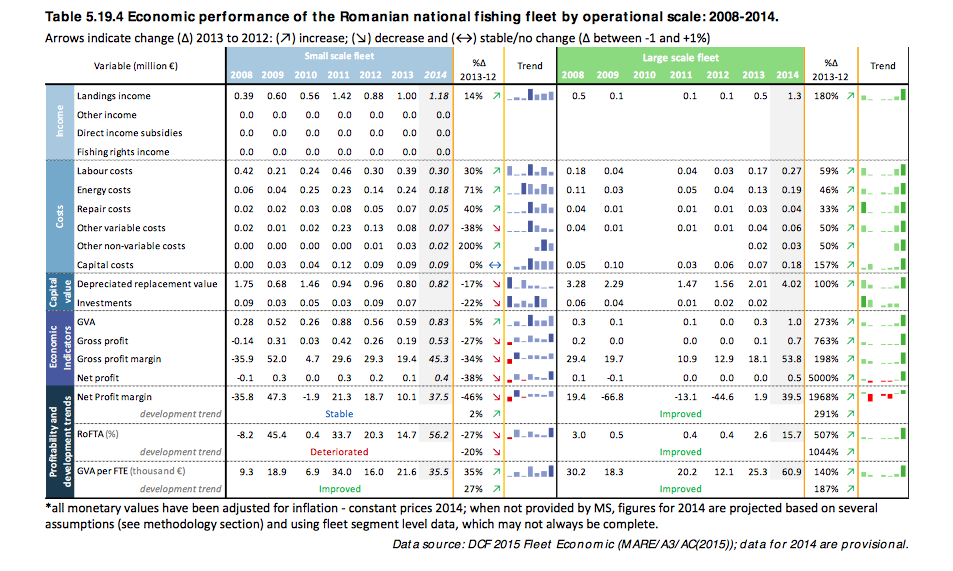

Romania

Report, p.349.

RoFTA large-scale fleet 15.7%, small-scale fleet 56.2%

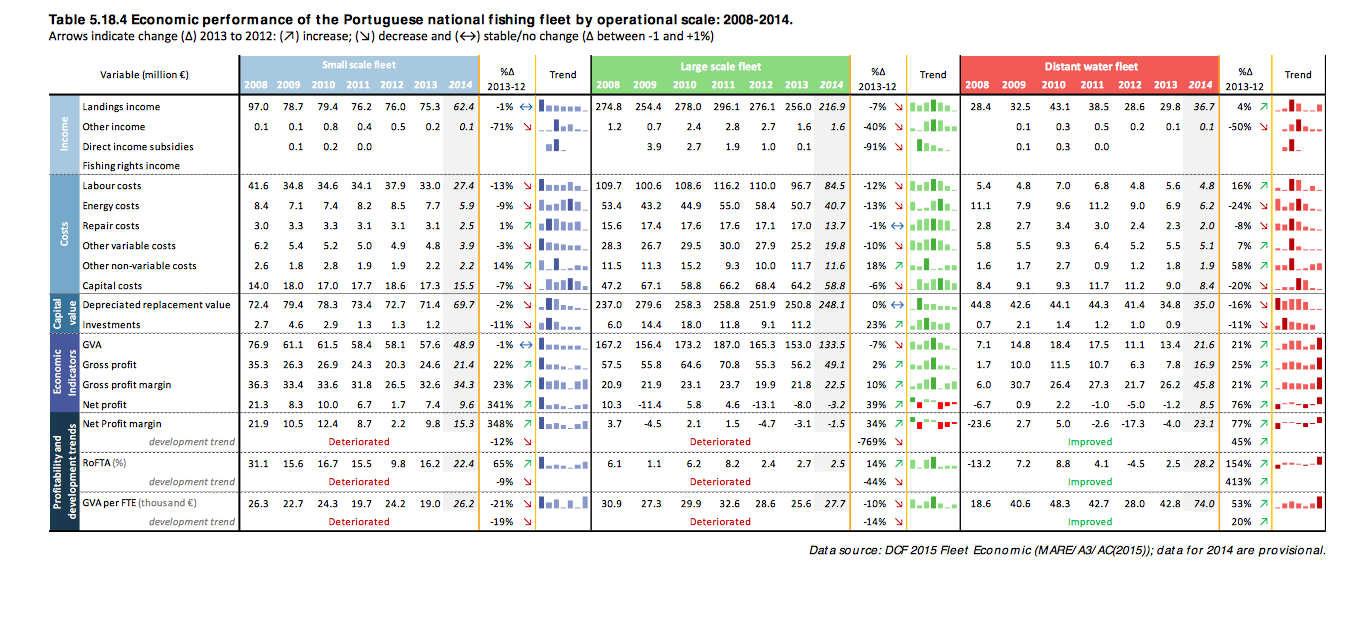

Portugal

Report, 331.

RoFTA large-scale fleet 2.3%, small-scale fleet 22.4%, distant water fleet 28.2%

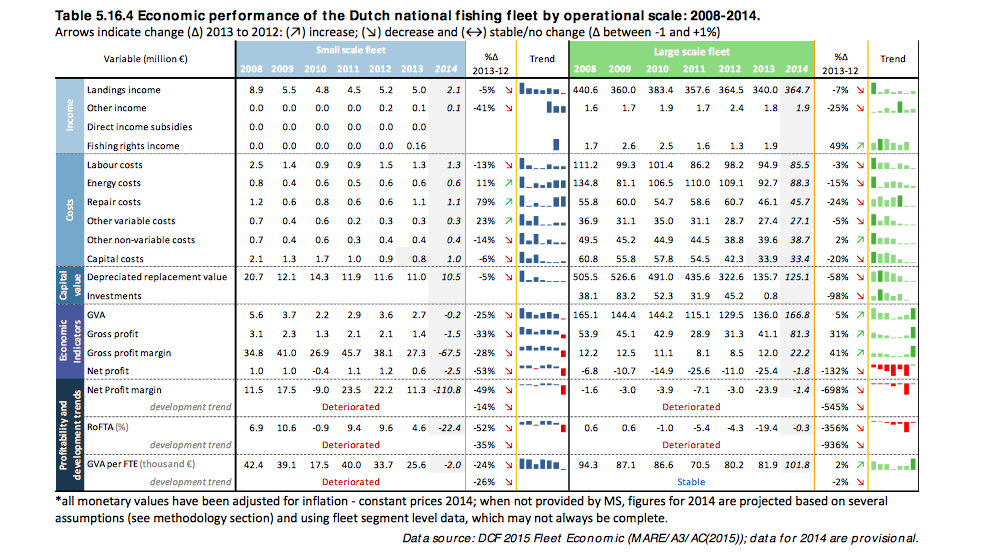

Netherlands

Report, p.311.

RoFTA large-scale fleet – 0.3%, small-scale fleet – 22.4%

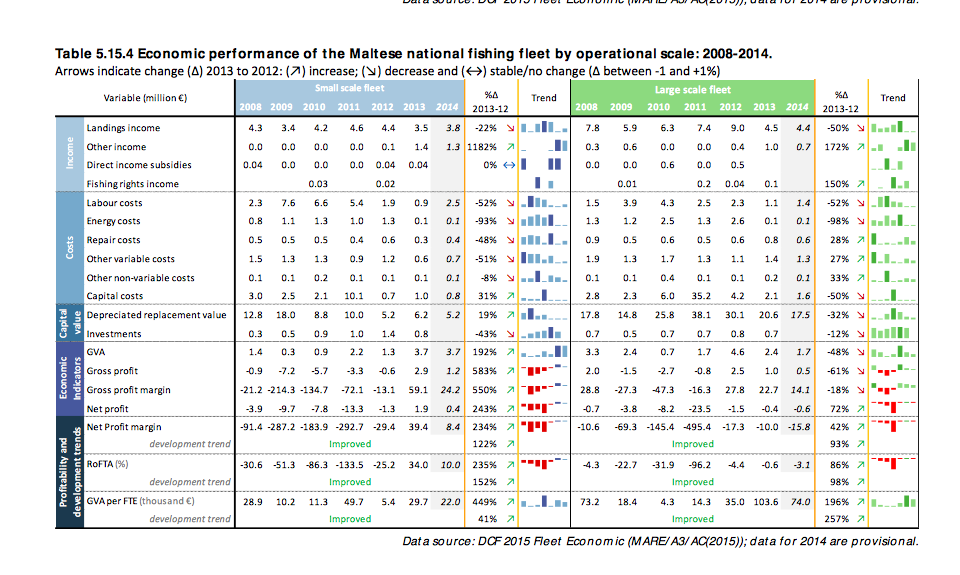

Malta

Report, p.303.

RoFTA large-scale fleet – 3.1%, small-scale fleet 10%

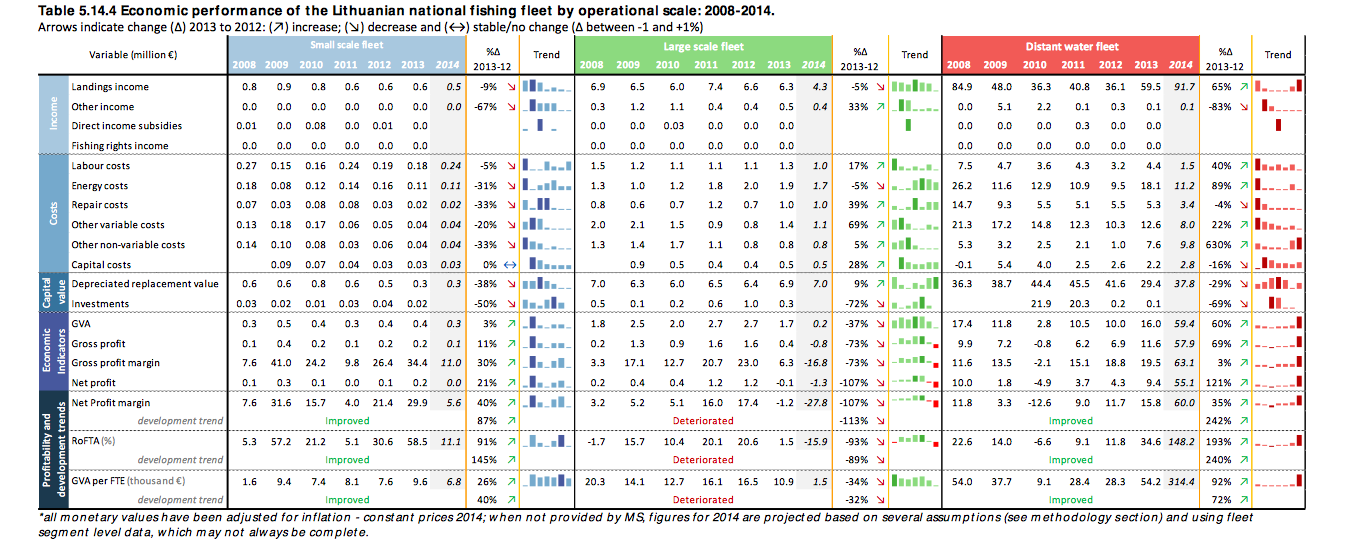

Lithuania

See Report, p.204.

RoFTA large-scale fleet – 15.9%, small-scale fleet 11.1 %, distant water fleet 314.4%

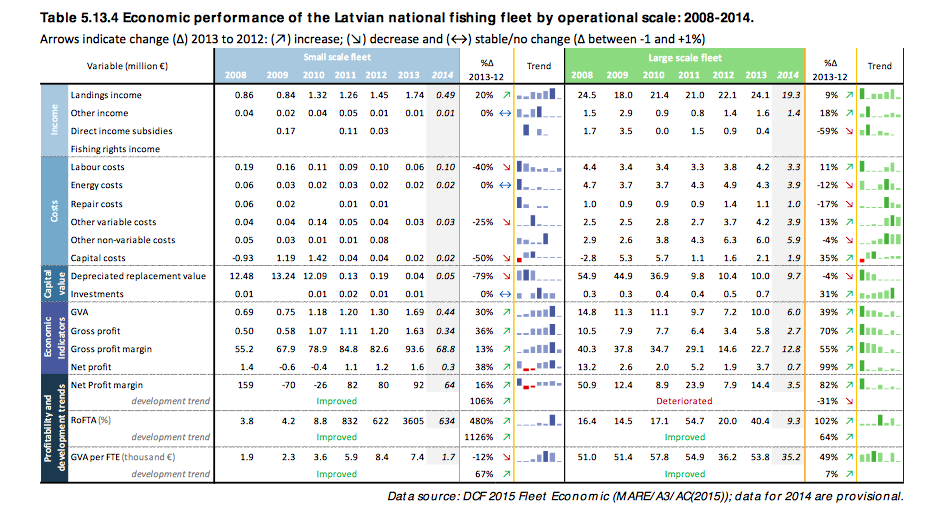

Latvia

Report, p.280.

RoFTA large-scale fleet 6,4%, small-scale fleet 3.5%

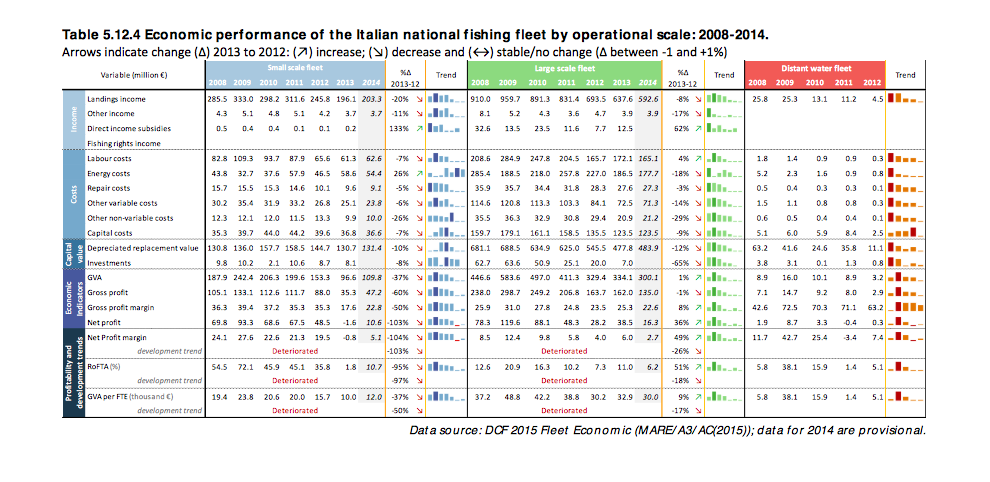

Italy

Report, p.270.

RoFTA large-scale fleet 30%, small-scale fleet 12%, distant water fleet 5.1%.

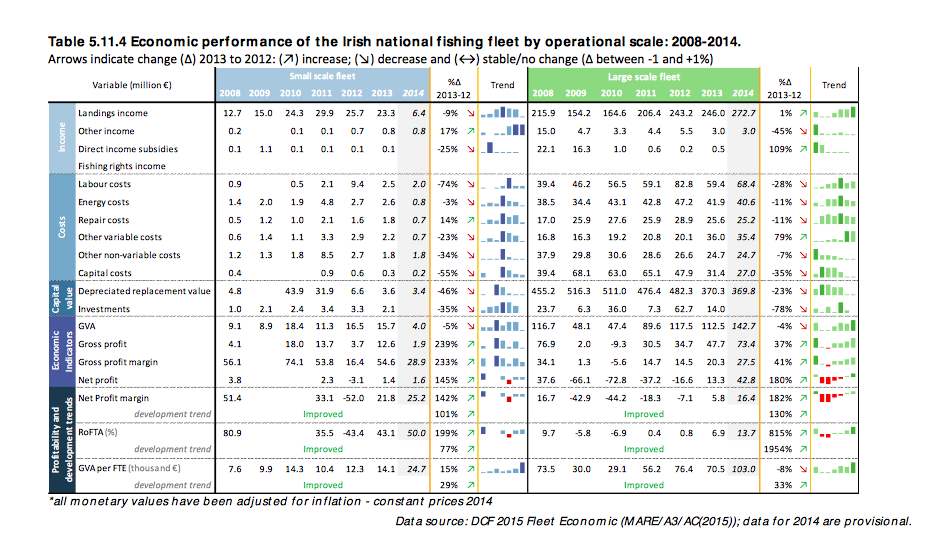

Ireland

Report, p.257.

RoFTA large-scale fleet 13.7%, small-scale fleet 50%

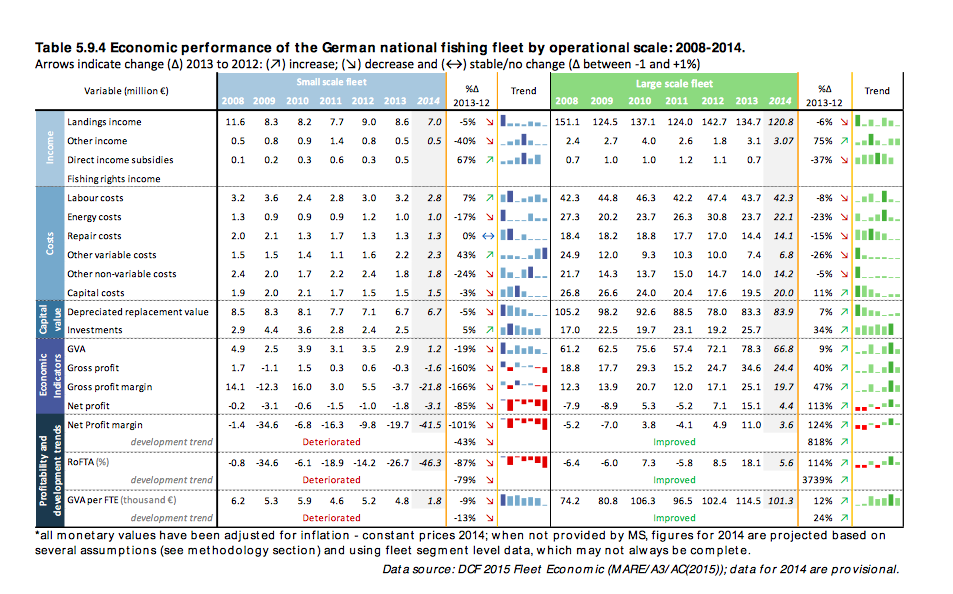

Germany

Report, p.239.

RoFTA large-scale fleet 5.6%, small-scale fleet -46.3%

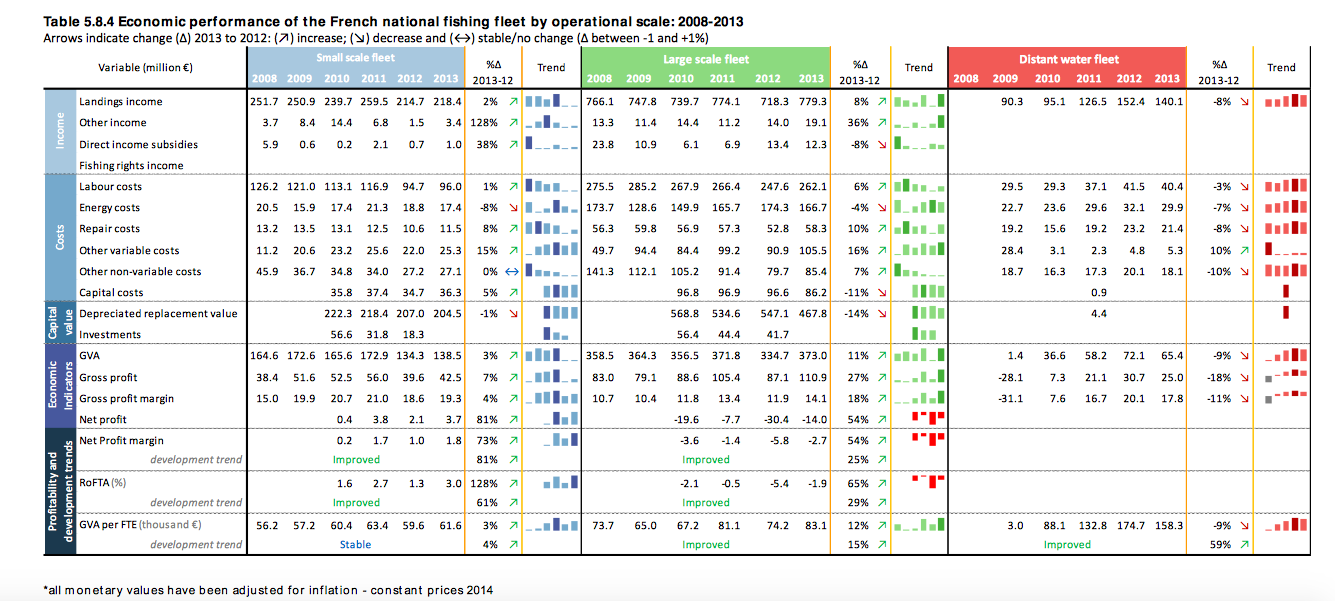

France

Report, p.229.

RoFTA large-scale fleet -1.9%, small-scale fleet 3.0%, distant water fleet N/A

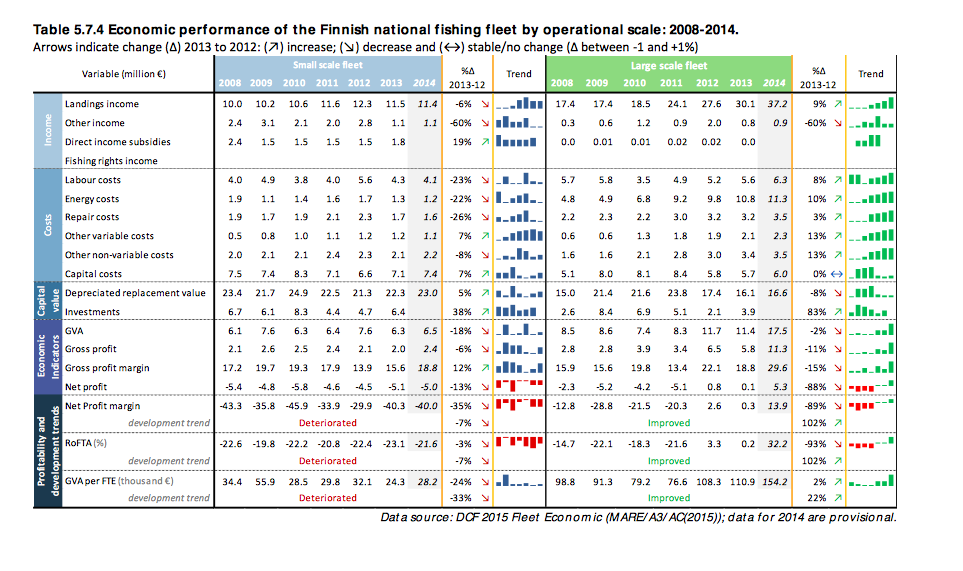

Finland

Report, p.214.

RoFTA large-scale fleet 32.2%, small-scale fleet -21.6%

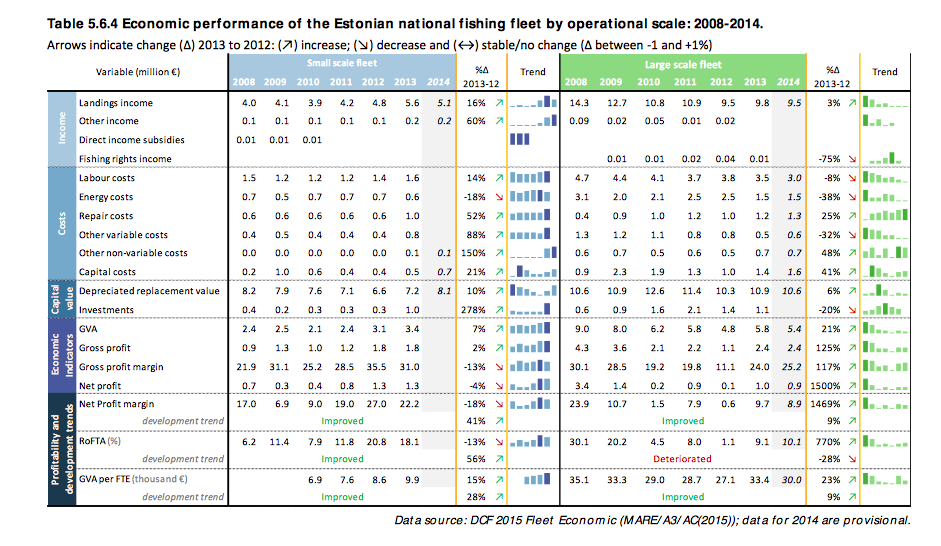

Estonia

Report, p.204.

RoFTA large-scale fleet 10.1%, small-scale fleet 18.1%

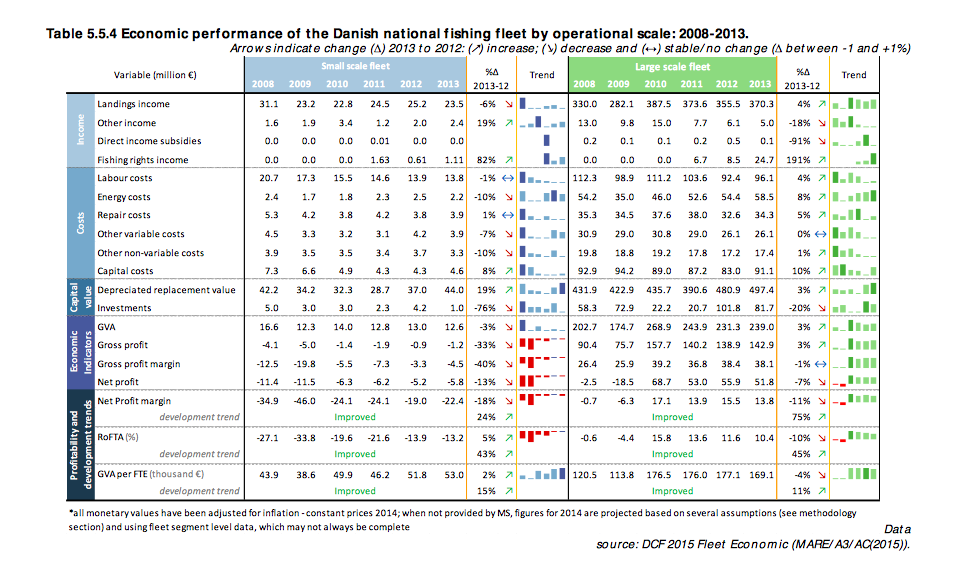

Denmark

Report, p.194.

RoFTA large-scale fleet 10.4%, small-scale fleet -13.2%

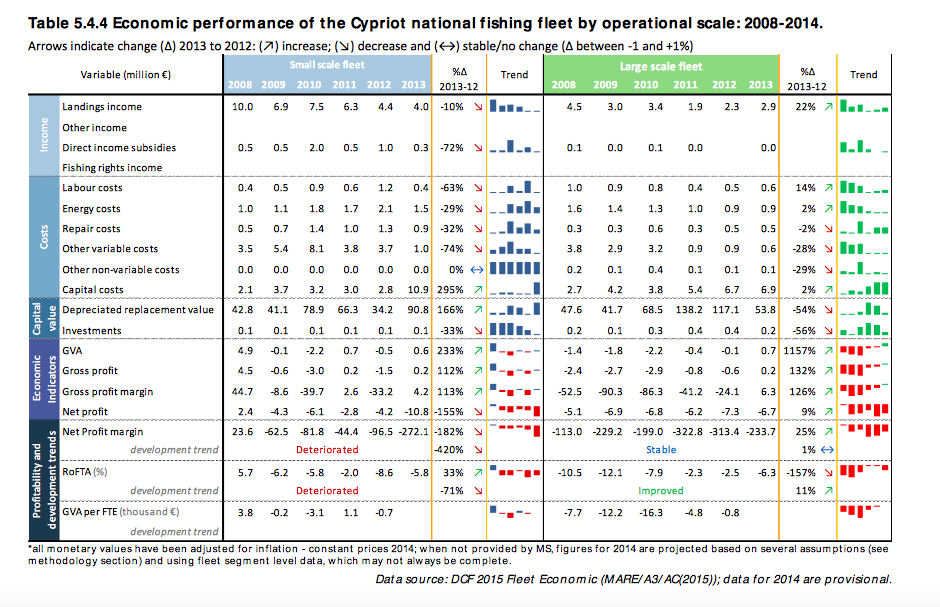

Cyprus

Report, p.187.

RoFTA large-scale fleet -6.3%, small-scale fleet -5.8%

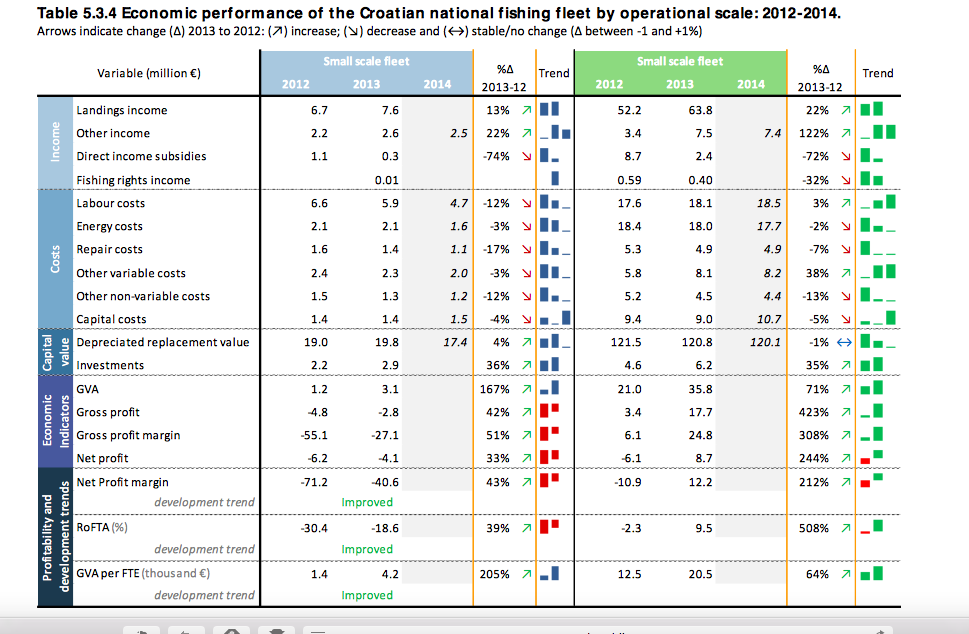

Croatia

Report,p.179.

RoFTA large-scale fleet 12.2%, small-scale fleet -18.6%

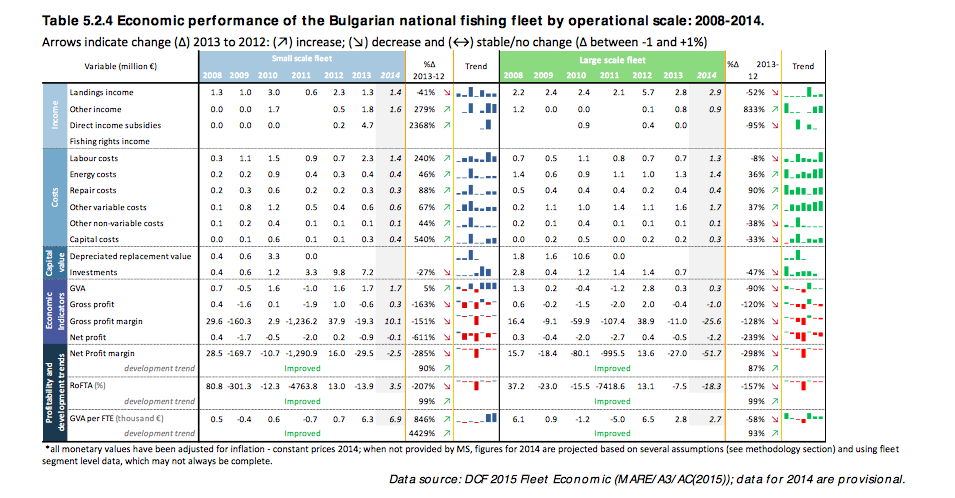

Bulgaria

Report,p.171.

RoFTA large-scale fleet -18.6%, small-scale fleet 3.5%

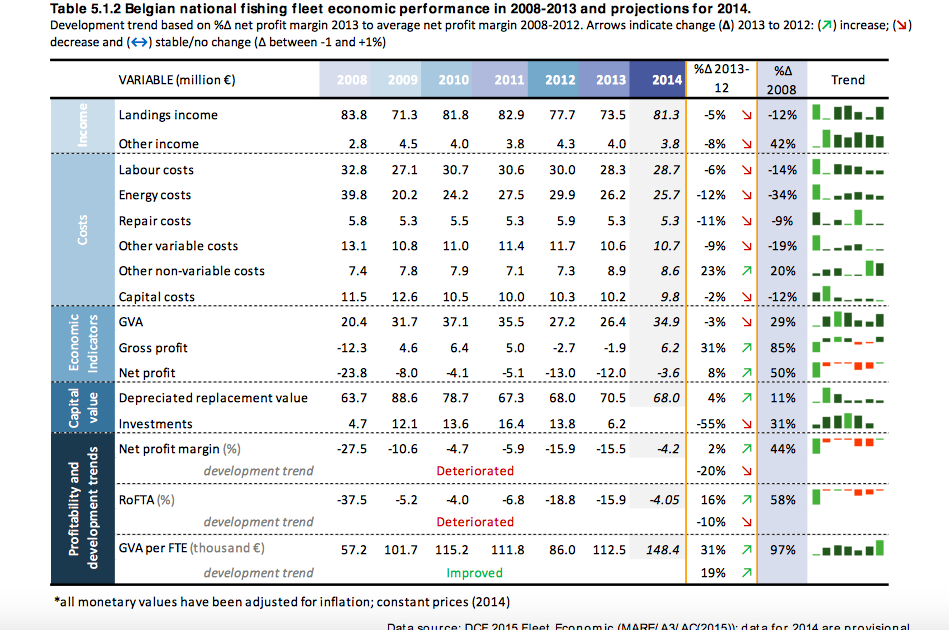

Belgium

Report, p.160.

RoFTA large and small scale fleet – 4.05%